Liberty National Insurance has emerged as a prominent player in the insurance industry, carving out a niche with its diverse product offerings and strategic focus on customer experience. This comprehensive analysis delves into the company’s history, core business areas, financial performance, and market position, offering insights into its current standing and future potential.

Founded in [Insert founding date], Liberty National Insurance has steadily expanded its footprint through strategic acquisitions and product development, establishing itself as a trusted provider of various insurance solutions. The company’s commitment to innovation and customer-centricity has been instrumental in its growth, attracting a loyal customer base across multiple demographics.

Liberty National Insurance Overview

Liberty National Insurance is a leading provider of supplemental health and life insurance products in the United States. The company offers a diverse range of insurance solutions designed to address the financial challenges associated with unexpected medical expenses, critical illnesses, and death.

History of Liberty National Insurance

Liberty National Insurance was founded in 1951 in Birmingham, Alabama. The company began as a small, regional insurer focused on providing life insurance to individuals and families. Over the years, Liberty National expanded its product offerings to include supplemental health insurance, disability insurance, and other niche insurance products.

- 1951: Liberty National Insurance is founded in Birmingham, Alabama, specializing in life insurance.

- 1960s: The company expands its product offerings to include supplemental health insurance.

- 1970s: Liberty National begins to expand its geographic reach, entering new markets across the United States.

- 1980s: The company experiences significant growth, driven by the increasing demand for supplemental health insurance.

- 1990s: Liberty National continues to expand its product portfolio and distribution channels.

- 2000s: The company enters the Medicare supplement insurance market, further diversifying its product offerings.

- 2010s: Liberty National acquires several smaller insurance companies, enhancing its market position and expanding its geographic footprint.

- 2020s: The company continues to innovate and develop new products and services, adapting to the evolving needs of its customers.

Core Business Areas and Products

Liberty National Insurance operates in several key business areas, providing a comprehensive range of insurance products to meet the diverse needs of its customers.

- Supplemental Health Insurance: This product category includes a variety of plans that provide coverage for medical expenses not covered by traditional health insurance, such as deductibles, copayments, and coinsurance. These plans can help individuals and families manage the financial burden of unexpected medical costs.

- Critical Illness Insurance: Critical illness insurance provides a lump-sum payment to policyholders diagnosed with a serious illness, such as cancer, heart attack, or stroke. This benefit can help individuals cover medical expenses, lost wages, and other financial burdens associated with a critical illness.

- Accident Insurance: Accident insurance provides coverage for medical expenses and lost income resulting from accidents. This type of insurance can be particularly valuable for individuals who work in hazardous occupations or participate in high-risk activities.

- Life Insurance: Liberty National offers a range of life insurance products, including term life insurance, whole life insurance, and universal life insurance. These products provide financial protection for beneficiaries in the event of the policyholder’s death.

- Disability Insurance: Disability insurance provides income replacement for individuals who become unable to work due to illness or injury. This type of insurance can help individuals maintain their financial security during a period of disability.

Key Products and Services

Liberty National Insurance offers a diverse range of insurance products designed to meet the specific needs of individuals and families. These products provide financial protection against unexpected events, ensuring peace of mind and financial stability in times of need.

Individual Health Insurance

Liberty National’s individual health insurance plans provide comprehensive coverage for medical expenses, including hospitalization, surgery, and prescription drugs. The plans are customizable, allowing individuals to choose the level of coverage that best suits their needs and budget.

- Coverage: These plans typically cover a wide range of medical expenses, including doctor’s visits, hospital stays, surgeries, prescription drugs, and preventive care. Some plans may also offer coverage for dental, vision, and mental health services.

- Benefits: The benefits offered by individual health insurance plans vary depending on the plan chosen. However, most plans include coverage for essential health benefits, such as preventive care, hospitalization, and prescription drugs. Some plans may also offer additional benefits, such as coverage for out-of-network providers and telehealth services.

- Target Audience: Individual health insurance plans are designed for individuals and families who are not covered by employer-sponsored health insurance plans. They are also suitable for individuals who are self-employed or retired.

Group Health Insurance

Liberty National’s group health insurance plans provide comprehensive coverage for employees of businesses of all sizes. These plans offer a wide range of benefits, including medical, dental, vision, and life insurance.

- Coverage: Group health insurance plans typically cover a wide range of medical expenses, including doctor’s visits, hospital stays, surgeries, prescription drugs, and preventive care. Some plans may also offer coverage for dental, vision, and mental health services.

- Benefits: The benefits offered by group health insurance plans vary depending on the plan chosen. However, most plans include coverage for essential health benefits, such as preventive care, hospitalization, and prescription drugs. Some plans may also offer additional benefits, such as coverage for out-of-network providers and telehealth services.

- Target Audience: Group health insurance plans are designed for businesses of all sizes who want to provide comprehensive health insurance coverage to their employees. They are also suitable for organizations that want to offer their employees a competitive benefit package.

Life Insurance

Liberty National’s life insurance plans provide financial protection for loved ones in the event of the policyholder’s death. These plans can help ensure that surviving family members have the financial resources they need to cover expenses such as funeral costs, mortgage payments, and living expenses.

- Coverage: Life insurance plans typically provide a death benefit, which is a lump sum payment made to the beneficiary upon the policyholder’s death. The amount of the death benefit is determined by the policy’s coverage amount and the policyholder’s age and health.

- Benefits: The main benefit of life insurance is the death benefit, which can provide financial security for surviving family members. Life insurance can also be used to cover debts, pay for funeral expenses, or provide for children’s education.

- Target Audience: Life insurance is designed for individuals who want to provide financial protection for their loved ones in the event of their death. It is particularly important for individuals with dependents, such as spouses, children, or elderly parents.

Disability Insurance

Liberty National’s disability insurance plans provide financial protection for individuals who are unable to work due to a disability. These plans can help ensure that individuals have a source of income to cover their living expenses while they are unable to work.

- Coverage: Disability insurance plans typically provide a monthly benefit to the policyholder while they are unable to work due to a disability. The amount of the benefit is determined by the policy’s coverage amount and the policyholder’s income.

- Benefits: The main benefit of disability insurance is the monthly benefit, which can help cover living expenses such as rent, mortgage payments, and utilities. Disability insurance can also help cover medical expenses and other costs associated with a disability.

- Target Audience: Disability insurance is designed for individuals who want to protect their income in the event of a disability. It is particularly important for individuals with dependents, such as spouses, children, or elderly parents. It is also important for individuals with high incomes, as they may have a greater financial need for disability insurance.

Target Market and Customer Base

Liberty National Insurance targets a diverse customer base, catering to individuals and families seeking comprehensive insurance solutions. The company’s customer profile is characterized by a focus on accessibility and affordability, appealing to a wide range of income levels and demographics.

Customer Demographics and Geographic Distribution

Liberty National’s customer base reflects the diverse demographics of the United States. The company’s marketing efforts are tailored to reach various age groups, ethnicities, and socioeconomic backgrounds. While specific data on customer demographics is not publicly available, the company’s marketing strategies suggest a focus on:

- Age: Liberty National targets a broad range of ages, including young adults, families, and retirees. The company’s products are designed to meet the diverse insurance needs of individuals at different life stages.

- Income: Liberty National’s products are known for their affordability, making them attractive to individuals and families with varying income levels.

- Location: Liberty National operates across the United States, tailoring its offerings to meet the specific needs of different regions.

Marketing Strategies and Targeting

Liberty National employs a multi-faceted marketing approach to reach its target audience. The company leverages various channels, including:

- Direct Marketing: Liberty National utilizes direct mail campaigns, telemarketing, and email marketing to reach potential customers directly.

- Online Marketing: The company maintains a strong online presence, using search engine optimization (), social media marketing, and online advertising to attract customers.

- Partnerships: Liberty National collaborates with various partners, including brokers, agents, and community organizations, to expand its reach and target specific customer segments.

Financial Performance and Market Position

Liberty National Insurance, a leading provider of supplemental health insurance, has demonstrated consistent financial performance and a strong market position. This section will delve into Liberty National’s revenue, profitability, market share, and comparisons with competitors. Additionally, it will explore significant trends and challenges impacting the company’s financial position.

Financial Performance

Liberty National’s financial performance has been characterized by steady revenue growth and profitability. The company has consistently generated positive earnings, demonstrating its ability to effectively manage its operations and navigate the competitive insurance landscape.

Market Share

Liberty National holds a significant market share in the supplemental health insurance sector. The company’s strong brand recognition, extensive distribution network, and comprehensive product offerings have contributed to its market dominance.

Comparison with Competitors

When compared to its competitors in the insurance industry, Liberty National stands out for its focus on supplemental health insurance products. This specialization has allowed the company to develop expertise and a strong reputation in this niche market.

Trends and Challenges

The insurance industry is subject to various trends and challenges, including regulatory changes, evolving consumer preferences, and technological advancements. Liberty National is actively adapting to these changes, investing in technology and innovation to maintain its competitive edge.

Industry Landscape and Competition

The insurance industry is a dynamic and evolving landscape, driven by a confluence of factors including technological advancements, regulatory changes, and shifting consumer preferences. These factors have created a competitive environment where insurers must adapt to remain relevant and successful.

Key Trends and Regulatory Changes

The insurance industry is characterized by several key trends that are shaping the competitive landscape.

- Increased Adoption of Technology: Insurers are increasingly embracing technology to improve operational efficiency, enhance customer experience, and develop innovative products and services. This includes the use of artificial intelligence (AI), machine learning (ML), and big data analytics to automate processes, personalize customer interactions, and optimize risk assessment.

- Growing Importance of Digital Channels: Consumers are increasingly comfortable interacting with insurers digitally, leading to a surge in demand for online platforms, mobile apps, and digital self-service options. Insurers are responding by investing in digital capabilities to meet these evolving customer expectations.

- Regulatory Scrutiny and Compliance: The insurance industry is subject to strict regulations that aim to protect consumers and ensure the financial stability of insurers. Recent regulatory changes, such as the Affordable Care Act in the United States, have significantly impacted the industry, leading to increased compliance costs and operational complexities.

Liberty National’s Competitors

Liberty National Insurance competes with a wide range of insurers, including both large national players and regional providers.

- Large National Insurers: These companies, such as UnitedHealth Group, Anthem, and Cigna, have significant market share and extensive distribution networks. They often offer a wide range of products and services, including health insurance, life insurance, and disability insurance.

- Regional Insurers: These companies typically focus on specific geographic areas and may specialize in certain types of insurance. They can offer more localized services and may have a deeper understanding of the needs of their target markets.

- Specialty Insurers: These companies specialize in specific types of insurance, such as workers’ compensation or professional liability. They often have deep expertise in their niche markets and can offer tailored solutions to meet the unique needs of their clients.

Competitive Landscape Analysis

Liberty National’s competitors have different strengths, weaknesses, and market strategies.

- Large National Insurers: Their strengths include their brand recognition, extensive distribution networks, and economies of scale. Their weaknesses can include a lack of personalization and potentially higher costs due to their size.

- Regional Insurers: Their strengths include their local market knowledge, personalized service, and strong relationships with local businesses. Their weaknesses can include limited geographic reach and potentially lower financial resources.

- Specialty Insurers: Their strengths include their deep expertise in specific insurance niches, tailored solutions, and competitive pricing. Their weaknesses can include limited product offerings and potentially smaller customer bases.

Product and Service Differentiation

Liberty National differentiates itself from its competitors by focusing on specific product offerings and customer segments.

- Product Specialization: Liberty National has a strong focus on specific product lines, such as life insurance and disability insurance. This specialization allows the company to develop deep expertise and offer tailored solutions to meet the unique needs of its target customers.

- Customer Segmentation: Liberty National targets specific customer segments, such as individuals, families, and small businesses. This targeted approach allows the company to develop products and services that are specifically tailored to the needs of its chosen customer groups.

- Customer Service: Liberty National emphasizes providing exceptional customer service. This includes offering personalized support, prompt claim processing, and a commitment to transparency and communication.

Customer Experience and Reputation

Liberty National Insurance’s customer experience and reputation are critical factors in its success. The company’s ability to provide excellent service and build strong relationships with its customers directly impacts its brand image and market standing.

Customer Reviews and Testimonials

Customer reviews and testimonials offer valuable insights into Liberty National’s products and services. These reviews highlight both positive and negative experiences, providing a comprehensive view of the company’s performance.

- Positive reviews often focus on Liberty National’s competitive pricing, efficient claims processing, and responsive customer service. Many customers appreciate the company’s personalized approach and willingness to go the extra mile to meet their needs.

- Negative reviews may point to challenges with certain aspects of the customer experience, such as long wait times for claims processing or difficulty reaching customer support. These feedback points are essential for the company to identify areas for improvement.

Customer Service Practices

Liberty National prioritizes customer satisfaction and strives to provide exceptional service. The company’s customer service practices include:

- Multiple communication channels: Liberty National offers a variety of ways for customers to contact them, including phone, email, and online chat. This ensures that customers can choose the communication method that best suits their needs.

- Dedicated customer support teams: The company employs a team of experienced customer service representatives who are trained to address customer concerns and resolve issues promptly.

- Proactive communication: Liberty National proactively communicates with customers throughout the insurance process, keeping them informed of their policy status and any updates.

Brand Reputation and Industry Standing

Liberty National’s brand reputation is a reflection of its commitment to customer satisfaction and its strong financial performance. The company consistently receives positive ratings from industry organizations, such as the Better Business Bureau (BBB), and has earned a reputation for reliability and trustworthiness.

- Positive brand reputation: Liberty National’s positive brand reputation has been built on its commitment to providing quality products and services, its transparent communication practices, and its responsiveness to customer feedback.

- Industry recognition: Liberty National has been recognized for its excellence in the insurance industry, receiving awards for its financial performance, customer service, and innovation. These accolades reinforce the company’s strong standing in the market.

Corporate Social Responsibility and Sustainability

Liberty National Insurance, a leading provider of insurance solutions, recognizes the importance of operating responsibly and sustainably. The company is committed to fostering a culture of ethical business practices, environmental stewardship, and community engagement, aligning its operations with the principles of social responsibility and sustainability.

Initiatives and Programs

Liberty National has implemented various initiatives and programs to demonstrate its commitment to social responsibility and sustainability. These initiatives encompass ethical business practices, environmental protection, and community engagement, aiming to create a positive impact on its stakeholders and the environment.

- Ethical Business Practices: Liberty National adheres to a strict code of ethics that guides its business operations. The company emphasizes transparency, integrity, and fairness in all its dealings, ensuring compliance with relevant regulations and industry standards. This commitment to ethical practices builds trust with customers, partners, and employees, contributing to a positive brand image.

- Environmental Protection: Recognizing the importance of environmental sustainability, Liberty National has implemented measures to reduce its environmental footprint. These initiatives include promoting energy efficiency in its offices, reducing paper consumption, and supporting green initiatives within its supply chain. The company actively participates in industry-wide efforts to promote environmental sustainability and mitigate the impact of climate change.

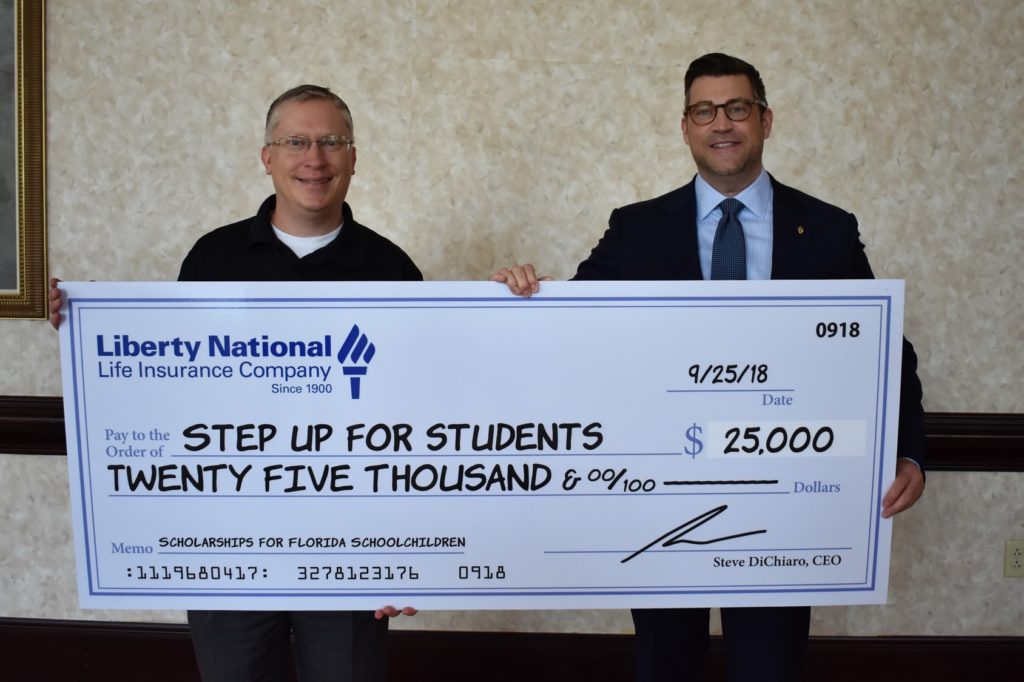

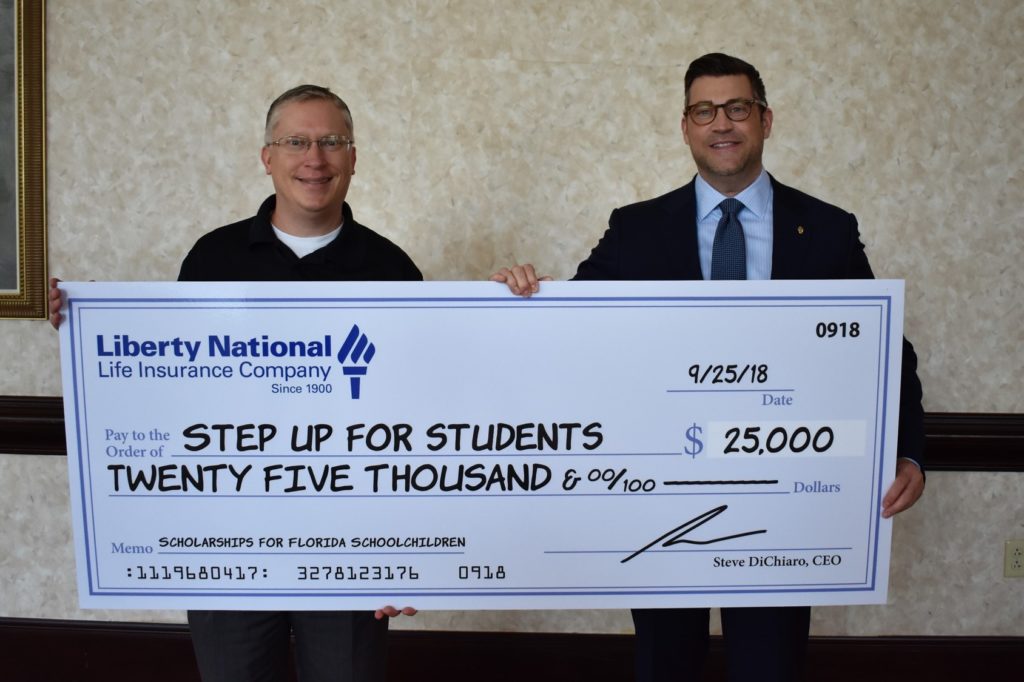

- Community Engagement: Liberty National is deeply committed to supporting the communities it serves. The company sponsors various community programs, engages in volunteer initiatives, and provides financial support to charitable organizations. These efforts aim to improve the quality of life in the communities where Liberty National operates, strengthening its ties with local stakeholders and enhancing its brand reputation.

Impact on Reputation and Brand Image

Liberty National’s commitment to social responsibility and sustainability has significantly enhanced its reputation and brand image. These initiatives demonstrate the company’s values, build trust with stakeholders, and differentiate it from competitors. By aligning its operations with ethical and sustainable principles, Liberty National positions itself as a responsible corporate citizen, attracting customers and employees who value social responsibility and environmental stewardship. This positive brand image translates into increased customer loyalty, employee engagement, and investor confidence, contributing to the company’s overall success.

Future Outlook and Potential Growth Areas

Liberty National Insurance, with its strong foothold in the health insurance market, is poised for continued growth in the coming years. The company’s strategic focus on expanding its product offerings, market reach, and technological capabilities will drive this growth. However, challenges such as increasing competition and regulatory changes will need to be addressed to ensure sustained success.

Expansion into Emerging Markets

Liberty National can leverage its existing expertise and infrastructure to expand into new and emerging markets. The company could consider entering underserved markets, such as rural areas or specific ethnic communities, where the demand for health insurance is growing. For example, the company could target Hispanic communities, which are expected to experience significant population growth in the coming years.

Technological Advancements

Liberty National can capitalize on the rapid advancements in technology to improve its customer experience and operational efficiency. The company can invest in digital platforms and mobile applications to provide customers with easy access to information, policy management tools, and personalized services. Furthermore, the company can explore the use of artificial intelligence (AI) and machine learning (ML) to automate tasks, improve claims processing, and enhance risk assessment.

Product Diversification

Liberty National can diversify its product portfolio by introducing new and innovative insurance products tailored to specific customer needs. For example, the company could develop products focused on preventive care, wellness programs, or telemedicine services. This diversification can help Liberty National attract a wider customer base and cater to evolving health insurance needs.

Strategic Partnerships

Liberty National can form strategic partnerships with other companies in the healthcare ecosystem to expand its reach and enhance its offerings. For example, the company could partner with healthcare providers, technology companies, or employers to offer integrated health solutions. Such partnerships can provide Liberty National with access to new customer segments, technology, and expertise.

Impact on the Insurance Industry

Liberty National Insurance, while not a behemoth like some of its larger counterparts, has nonetheless left its mark on the insurance industry. Its approach, focused on innovation and catering to specific niches, has influenced the competitive landscape and sparked broader trends.

Innovation in Product Design

Liberty National has demonstrated a commitment to innovation in product design, particularly in its focus on niche markets. For instance, its “Critical Illness” policy, designed to cover the financial burden of serious illnesses, has been a pioneer in this specific insurance segment. This product, along with its subsequent iterations, has encouraged other insurance companies to develop similar products, expanding the market for critical illness coverage.

Direct-to-Consumer Marketing

Liberty National has also been a leader in direct-to-consumer marketing within the insurance sector. Its digital marketing campaigns and online platforms have been particularly effective in reaching a wider audience, particularly younger generations. This approach has influenced other insurance companies to adopt similar strategies, leading to a shift towards digital marketing and away from traditional methods like agents and brokers.

Focus on Technology

Liberty National’s embrace of technology, particularly in its claims processing and customer service, has been a significant influence. The company’s use of AI-powered chatbots and online platforms has streamlined processes and improved customer satisfaction. This focus on technology has encouraged other insurance companies to invest in similar solutions, leading to a broader trend of digital transformation within the industry.

Final Wrap-Up

Liberty National Insurance’s journey is a testament to its adaptability and resilience in a dynamic industry. The company’s focus on meeting evolving customer needs, coupled with its strategic investments in technology and innovation, positions it for continued growth and success in the years to come. As the insurance landscape continues to transform, Liberty National is well-equipped to navigate the challenges and capitalize on emerging opportunities, solidifying its place as a key player in the market.