Navigating the world of car insurance in New Jersey can feel like a labyrinth, especially when you’re searching for affordable options. The Garden State’s unique insurance landscape, with its blend of regulations and competitive market, requires a strategic approach. This guide aims to demystify the process, providing insights into key factors influencing car insurance costs, uncovering hidden discounts, and equipping you with the knowledge to make informed decisions.

From understanding the minimum coverage requirements to exploring various discounts and comparing quotes from top providers, this comprehensive resource empowers you to secure the best car insurance policy that fits your budget and driving needs.

Understanding Affordable Car Insurance in NJ

Navigating the world of car insurance in New Jersey can feel overwhelming, especially when you’re looking for affordable options. This guide will help you understand the factors that influence car insurance costs in NJ, the different types of coverage available, and provide tips for finding the best deals.

Factors Influencing Car Insurance Costs in NJ

Several factors contribute to the cost of car insurance in New Jersey. These include:

- Your driving record: A clean driving record with no accidents or traffic violations will generally result in lower premiums.

- Your age and gender: Younger drivers and males typically pay higher premiums due to their higher risk profiles.

- Your vehicle’s make and model: The type of car you drive plays a significant role. Expensive or high-performance vehicles are often more expensive to insure due to their higher repair costs and risk of theft.

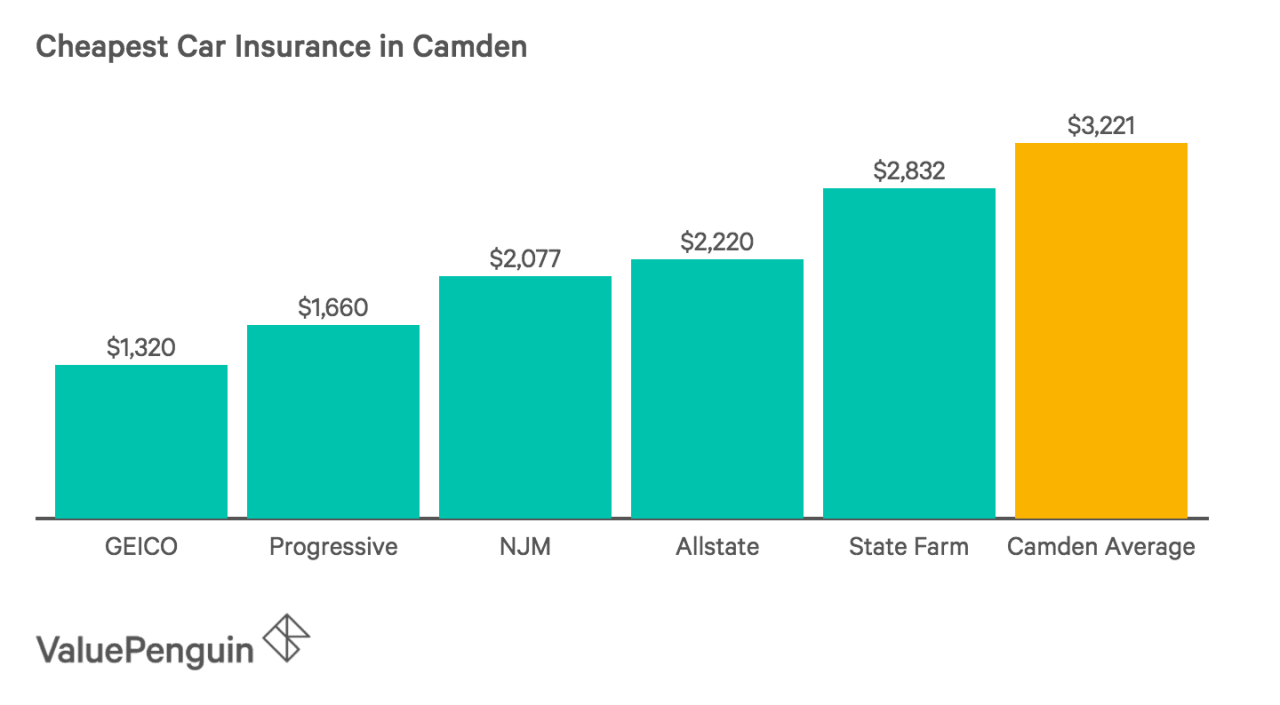

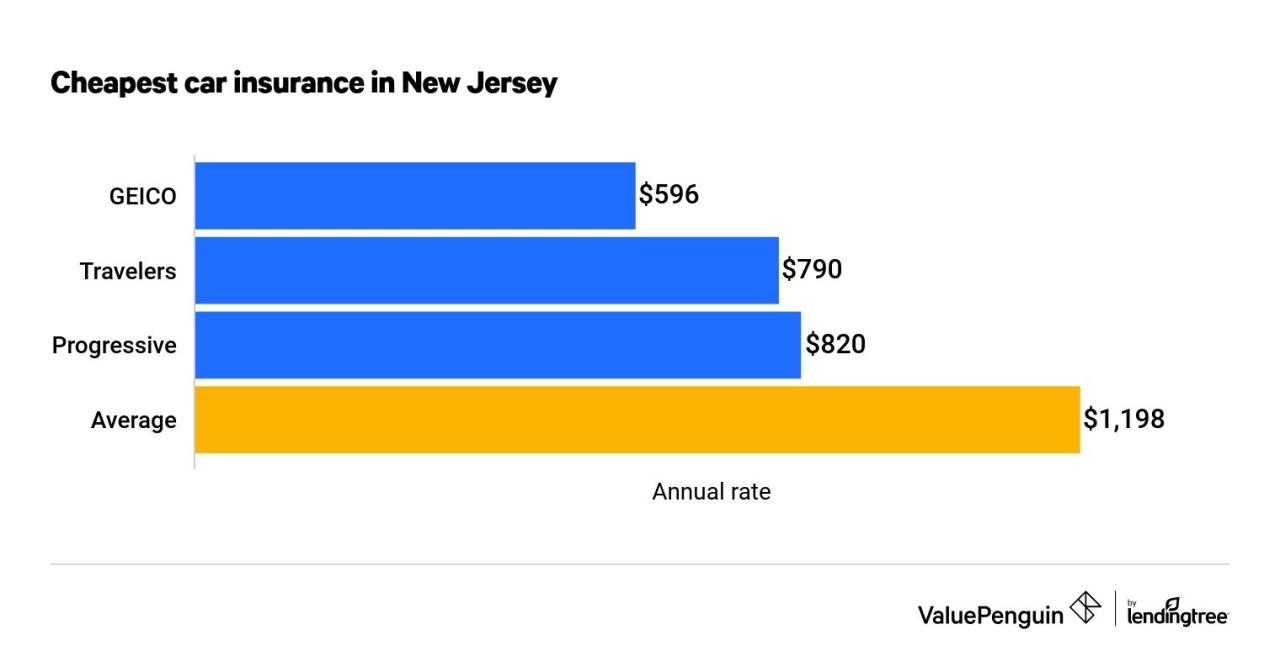

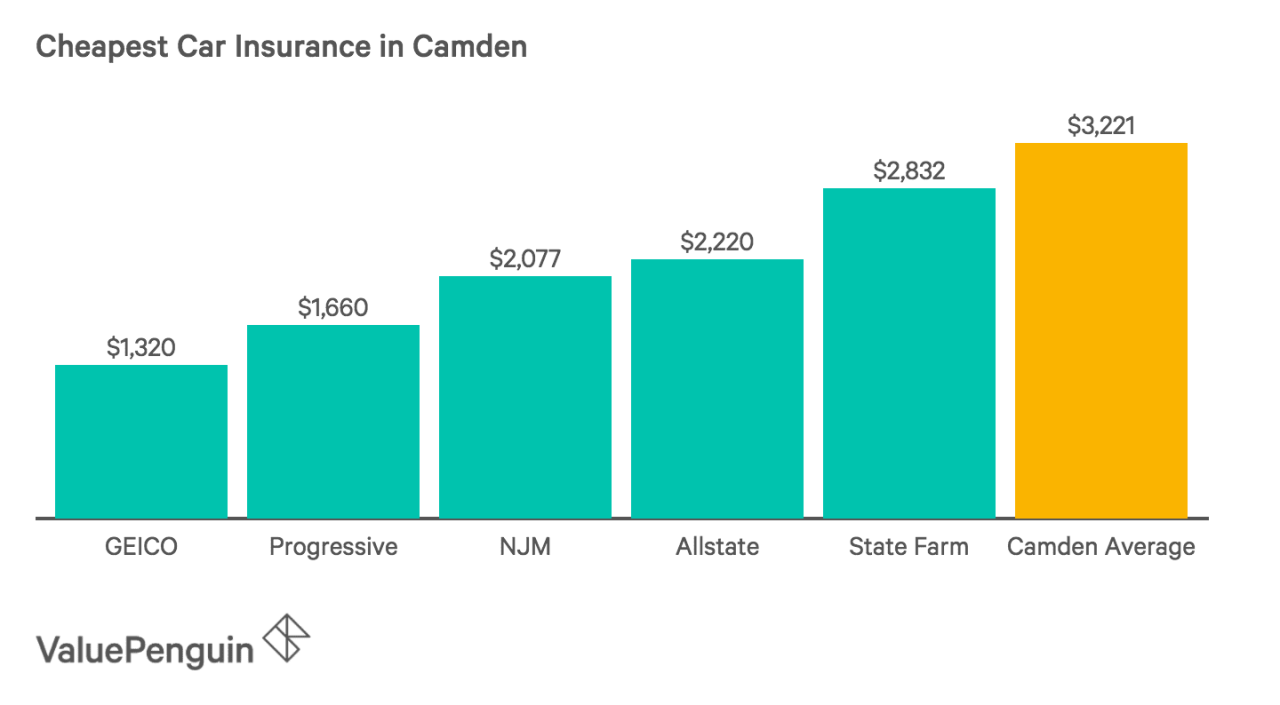

- Your location: Insurance rates vary depending on the area you live in. Urban areas with higher traffic density and crime rates tend to have higher insurance costs.

- Your credit score: In New Jersey, insurers can use your credit score to assess your risk. A good credit score can help you qualify for lower premiums.

- Your coverage choices: The type and amount of coverage you choose will directly impact your premium. More comprehensive coverage generally means higher premiums.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial for making informed decisions.

- Liability coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It is typically required by law in New Jersey.

- Collision coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault. This coverage is optional.

- Comprehensive coverage: This coverage protects you against damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters. This coverage is optional.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. This coverage is optional.

- Personal injury protection (PIP): This coverage covers your medical expenses and lost wages if you are injured in an accident, regardless of fault. This coverage is required in New Jersey.

Tips for Finding Affordable Car Insurance Options in NJ

Here are some tips to help you find affordable car insurance options:

- Shop around: Get quotes from multiple insurance companies to compare prices and coverage options.

- Consider increasing your deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can result in lower premiums.

- Ask about discounts: Many insurance companies offer discounts for good drivers, safe vehicles, multiple policies, and other factors.

- Maintain a good driving record: Avoiding accidents and traffic violations can significantly lower your insurance premiums.

- Bundle your insurance: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Take advantage of online tools: Many insurance companies offer online tools and calculators to help you estimate your insurance costs and find the best deals.

Comparing Car Insurance Quotes in NJ

Navigating the car insurance landscape in New Jersey can be overwhelming, with numerous providers offering a wide range of coverage options and prices. Comparing quotes from different insurers is essential to ensure you’re getting the best value for your money.

Comparing Car Insurance Quotes

To make an informed decision, it’s crucial to compare quotes from several reputable insurance companies. This involves gathering information on coverage options, discounts, and customer reviews.

Here’s a table comparing quotes from some of the top car insurance providers in New Jersey:

| Provider | Coverage Options | Discounts | Customer Reviews |

|---|---|---|---|

| State Farm | Comprehensive, collision, liability, personal injury protection (PIP), uninsured/underinsured motorist (UM/UIM), medical payments coverage (MedPay) | Safe driver, good student, multi-car, multi-policy, defensive driving, anti-theft device | 4.5 stars (based on independent reviews) |

| Geico | Comprehensive, collision, liability, PIP, UM/UIM, MedPay | Safe driver, good student, multi-car, multi-policy, defensive driving, anti-theft device | 4.3 stars (based on independent reviews) |

| Allstate | Comprehensive, collision, liability, PIP, UM/UIM, MedPay | Safe driver, good student, multi-car, multi-policy, defensive driving, anti-theft device | 4.2 stars (based on independent reviews) |

| Progressive | Comprehensive, collision, liability, PIP, UM/UIM, MedPay | Safe driver, good student, multi-car, multi-policy, defensive driving, anti-theft device | 4 stars (based on independent reviews) |

Remember, the best car insurance provider for you will depend on your individual needs and driving history. It’s important to compare quotes from multiple providers to find the most suitable option.

Discounts and Savings on Car Insurance in NJ

In the competitive car insurance market in New Jersey, finding the best deal is essential. Several discounts are available to help you lower your premiums and save money. Understanding these discounts and how to qualify for them can significantly reduce your annual insurance costs.

Common Car Insurance Discounts in NJ

Several discounts are available to New Jersey drivers, allowing them to reduce their car insurance premiums. These discounts can be categorized into several groups, each offering potential savings depending on your individual circumstances.

- Good Driver Discounts: A clean driving record, free from accidents and traffic violations, is a significant factor in determining your insurance rates. Maintaining a good driving record can lead to substantial discounts, often exceeding 10%.

- Safe Driver Discounts: Insurance companies reward drivers who take defensive driving courses or demonstrate safe driving habits through telematics programs. These programs track your driving behavior, such as speed, braking, and acceleration, offering discounts based on your safe driving performance.

- Multi-Policy Discounts: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, often leads to substantial discounts. Combining your policies with the same insurer can save you significantly on your overall premiums.

- Vehicle Safety Discounts: Insurance companies often offer discounts for vehicles equipped with advanced safety features, such as anti-theft devices, airbags, and anti-lock brakes. These features reduce the risk of accidents and injuries, leading to lower premiums.

- Loyalty Discounts: Staying with the same insurance company for an extended period can qualify you for loyalty discounts. These discounts reward long-term customers for their continued business.

- Group Discounts: Certain organizations or affiliations, such as alumni associations, professional groups, or employee groups, may offer discounts on car insurance. These discounts are often negotiated with insurance companies to benefit their members.

- Payment Discounts: Paying your car insurance premiums in full or opting for automatic payments can sometimes qualify you for discounts. These discounts incentivize prompt payment and reduce administrative costs for insurance companies.

Maximizing Savings on Car Insurance Discounts

To maximize your savings on car insurance discounts, consider the following strategies:

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is crucial for obtaining the most significant discounts.

- Explore Safe Driver Programs: Consider taking a defensive driving course or enrolling in a telematics program to demonstrate your safe driving habits.

- Bundle Your Insurance Policies: Combine your car insurance with other insurance policies, such as homeowners or renters insurance, to benefit from multi-policy discounts.

- Choose Vehicles with Safety Features: When purchasing a new car, consider vehicles equipped with advanced safety features to qualify for vehicle safety discounts.

- Stay with the Same Insurance Company: Maintaining a long-term relationship with your insurance company can earn you loyalty discounts.

- Explore Group Discounts: Check if your organization or affiliation offers discounts on car insurance.

- Pay Your Premiums Promptly: Pay your premiums in full or set up automatic payments to potentially qualify for payment discounts.

Real-Life Examples of Car Insurance Savings

- Sarah, a resident of New Jersey, bundled her car insurance with her homeowners insurance and received a 15% discount, saving her $200 annually.

- John, a safe driver with a clean record, received a 10% good driver discount, reducing his annual premium by $150.

- Emily, a member of a professional organization, qualified for a group discount, saving her $50 per year on her car insurance.

Understanding NJ’s Car Insurance Laws

Driving in New Jersey comes with certain legal responsibilities, and car insurance is a crucial part of that. The state mandates specific insurance coverage to protect drivers, passengers, and other road users in case of accidents. Understanding these laws is essential for all drivers in New Jersey.

Minimum Car Insurance Requirements in NJ

New Jersey requires all drivers to carry a minimum level of car insurance coverage, known as the “New Jersey Basic Automobile Insurance Policy.” This policy consists of four main types of coverage:

- Liability Coverage: This covers damages caused to other vehicles or property, as well as injuries to other people in an accident where you are at fault. The minimum liability coverage required in NJ is:

- Bodily Injury Liability: $15,000 per person / $30,000 per accident

- Property Damage Liability: $5,000 per accident

- Personal Injury Protection (PIP): This coverage provides medical benefits to you and your passengers, regardless of who is at fault in an accident. The minimum PIP coverage in NJ is $15,000.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you in case you are involved in an accident with an uninsured or underinsured driver. The minimum UM/UIM coverage in NJ is the same as the minimum liability coverage.

- No-Fault Coverage: This coverage allows you to access medical benefits and lost wages, regardless of fault, in the event of an accident.

Penalties for Driving Without Insurance

Driving without the minimum required insurance in New Jersey can result in significant penalties. These penalties can include:

- Fines: Drivers caught driving without insurance face fines ranging from $1,000 to $5,000, depending on the severity of the offense.

- License Suspension: Driving without insurance can lead to the suspension of your driver’s license. The length of the suspension can vary based on the circumstances.

- Vehicle Seizure: In some cases, the vehicle itself can be seized and impounded.

- Jail Time: If you are involved in an accident without insurance and cause serious injuries or property damage, you could face jail time.

Importance of Sufficient Coverage

While the minimum required coverage provides a baseline of protection, it may not be enough in certain situations. Consider these factors:

- High-Value Vehicles: If you drive a luxury car or a vehicle with significant value, the minimum property damage liability coverage might not be sufficient to cover repairs or replacement costs in an accident.

- High Medical Expenses: In the event of a serious accident, the minimum PIP coverage might not cover all medical expenses.

- Multiple Drivers: If you have multiple drivers in your household, the minimum coverage may not be adequate for all drivers’ needs.

Tips for Safe Driving in NJ

Safe driving practices in New Jersey not only contribute to your personal safety but also have a significant impact on your car insurance premiums. By adhering to safe driving habits, you can potentially lower your insurance costs and enjoy the benefits of a clean driving record.

Impact of Driving History on Insurance Rates

Your driving history is a primary factor considered by insurance companies when determining your premiums. A clean driving record translates into lower premiums, while incidents like accidents, traffic violations, or DUI convictions can lead to substantial increases.

Insurance companies assess your driving history to gauge your risk level. A history of safe driving demonstrates a lower risk, resulting in more favorable rates.

Maintaining a Good Driving Record

To ensure a good driving record and potentially reduce your insurance costs, follow these guidelines:

- Obey Traffic Laws: Adhering to speed limits, stopping at red lights, and following all traffic regulations is essential for safe driving and avoiding violations that can raise your premiums.

- Avoid Distracted Driving: Distracted driving, such as texting, talking on the phone, or eating while driving, is a major contributor to accidents. Focus solely on the road to maintain control and avoid potential violations.

- Practice Defensive Driving: Defensive driving involves anticipating potential hazards and reacting accordingly. Maintaining a safe distance from other vehicles, scanning for pedestrians and cyclists, and being aware of your surroundings can help prevent accidents.

- Maintain Your Vehicle: Regular vehicle maintenance, including oil changes, tire rotations, and brake inspections, is crucial for ensuring optimal performance and safety.

- Avoid Driving Under the Influence: Driving under the influence of alcohol or drugs is extremely dangerous and illegal. Always designate a sober driver or use alternative transportation if you plan to consume alcohol.

Navigating the Claims Process in NJ

Filing a car insurance claim in New Jersey can be a stressful experience, but understanding the process can help you navigate it smoothly. This section Artikels the steps involved, the necessary documentation, and tips for resolving claims efficiently.

Filing a Car Insurance Claim in NJ

The first step in filing a claim is to contact your insurance company as soon as possible after an accident. Your insurance company will provide you with instructions on how to file a claim, and they will assign you a claims adjuster who will handle your case.

Documentation Needed for a Car Insurance Claim in NJ

To ensure your claim is processed efficiently, you will need to gather the following documentation:

- Police Report: This document is essential for documenting the accident and is typically required by insurance companies.

- Photos of the Damage: Take clear pictures of the damage to your vehicle and the accident scene.

- Contact Information: Exchange contact information with the other parties involved in the accident, including their insurance details.

- Medical Records: If you sustained injuries in the accident, gather medical records from your doctor or hospital.

Resolving Car Insurance Claims in NJ

Once you have filed your claim and provided the necessary documentation, your claims adjuster will investigate the accident and determine the extent of the damage. They will then work with you to settle your claim, which can involve:

- Negotiating a Settlement: The claims adjuster will offer you a settlement amount based on their assessment of the damage. You have the right to negotiate this amount if you believe it is insufficient.

- Repairing or Replacing Your Vehicle: Your insurance company may arrange for your vehicle to be repaired at an approved shop or offer you a cash settlement to cover the cost of repairs or replacement.

- Paying Medical Expenses: If you were injured in the accident, your insurance company will cover your medical expenses, subject to the limits of your policy.

Tips for Navigating the Claims Process Smoothly

- Be Patient: The claims process can take time, especially if the accident is complex or involves multiple parties.

- Be Organized: Keep all documentation related to your claim in a safe and accessible location.

- Communicate Clearly: Be clear and concise in your communication with your insurance company and the claims adjuster.

- Understand Your Policy: Read your insurance policy carefully and understand your coverage limits and exclusions.

- Seek Legal Advice: If you are having difficulty resolving your claim or believe that your insurance company is not acting in good faith, you may want to consult with a lawyer.

Car Insurance for Different Driving Situations in NJ

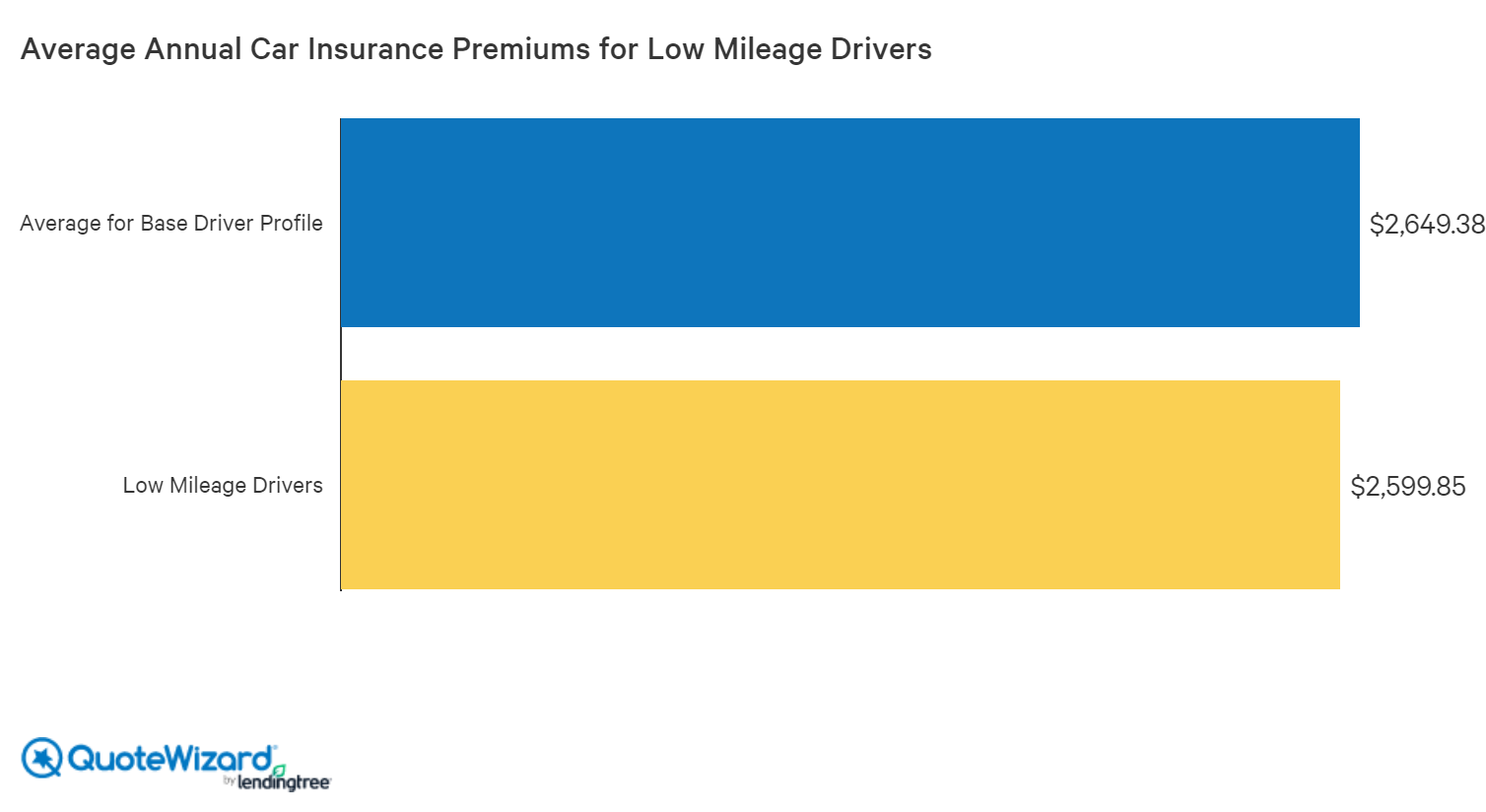

In New Jersey, car insurance needs vary based on individual circumstances. Factors such as age, driving history, vehicle type, and usage patterns significantly impact insurance costs and coverage requirements. Understanding these nuances is crucial for finding the most suitable and affordable car insurance policy.

Car Insurance for Young Drivers

Young drivers, typically those under the age of 25, are often considered higher risk by insurance companies due to their lack of experience and higher likelihood of accidents. Insurance premiums for young drivers tend to be higher. However, there are ways to mitigate these costs.

- Good Student Discounts: Maintaining good grades can qualify young drivers for discounts, demonstrating responsibility and maturity.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate a commitment to safe driving practices and potentially lead to lower premiums.

- Consider a Used Car: New cars are more expensive to insure due to their higher value. Choosing a used car can lower premiums.

- Limited Coverage: Consider a minimum coverage policy, such as liability only, if the vehicle is older or has a lower value. This can be a cost-effective option, but it’s crucial to weigh the risks and benefits carefully.

Car Insurance for Senior Drivers

While senior drivers often have extensive driving experience, they may face challenges related to age-related factors, such as vision or reaction time. Insurance companies may adjust premiums for seniors based on their driving history and age.

- Safe Driving Discounts: Maintaining a clean driving record with no accidents or violations can qualify seniors for discounts.

- Senior Driver Courses: Completing a senior driver safety course can demonstrate a commitment to safe driving and potentially lead to lower premiums.

- Consider a Lower-Priced Vehicle: Older vehicles generally have lower insurance premiums. If driving less frequently, a smaller or less expensive vehicle can be a cost-effective option.

Car Insurance for High-Risk Drivers

Individuals with a history of accidents, traffic violations, or DUI convictions are considered high-risk drivers. Insurance companies may charge higher premiums to reflect the increased risk they pose.

- Shop Around for Quotes: Compare quotes from multiple insurers, as pricing can vary significantly. Some insurers may be more lenient with high-risk drivers.

- Consider a Non-Standard Insurer: Non-standard insurers specialize in insuring high-risk drivers and may offer more competitive rates.

- Improve Your Driving Record: Maintaining a clean driving record for a period of time can demonstrate a commitment to safer driving and potentially lead to lower premiums.

Car Insurance for Different Vehicle Types

Insurance premiums vary based on the type of vehicle. Higher-value vehicles, such as luxury cars or sports cars, tend to have higher premiums due to their increased repair costs.

- Motorcycle Insurance: Motorcycle insurance is generally less expensive than car insurance, but it covers different risks, such as theft and damage to the motorcycle itself. Coverage options can include liability, collision, and comprehensive.

- Truck Insurance: Truck insurance premiums can be higher than car insurance, especially for commercial trucks. Coverage options can include liability, cargo insurance, and physical damage coverage.

Car Insurance for Specific Needs

Insurance needs can vary depending on specific circumstances, such as business use or frequent travel.

- Business Use: If using a vehicle for business purposes, additional coverage may be required, such as commercial auto insurance, which covers liability and damage to the vehicle while used for business activities.

- Frequent Travel: If driving frequently or traveling long distances, consider a policy that includes roadside assistance and rental car coverage. This can provide peace of mind in case of unexpected breakdowns or accidents.

Resources for Car Insurance Information in NJ

Navigating the complex world of car insurance in New Jersey can be daunting, but access to reliable information can empower you to make informed decisions. Numerous resources are available to help you understand your coverage options, compare rates, and ensure you’re getting the best value for your money.

Government Agencies

Government agencies play a crucial role in regulating and protecting consumers in the insurance industry. They provide valuable information and resources to help you understand your rights and responsibilities.

- New Jersey Department of Banking and Insurance (DOBI): The DOBI is the primary regulatory body for the insurance industry in New Jersey. It oversees insurance companies, investigates consumer complaints, and provides educational materials on various insurance topics.

- Website: [https://www.nj.gov/dobi/](https://www.nj.gov/dobi/)

- Phone: (609) 292-5000

- Address: 20 West State Street, Trenton, NJ 08625

Consumer Protection Resources

Consumer protection organizations advocate for consumers’ rights and provide guidance on navigating insurance issues. They offer valuable resources, including complaint filing mechanisms and educational materials.

- New Jersey Division of Consumer Affairs: This division handles consumer complaints and provides information on consumer protection laws in New Jersey.

- Website: [https://www.njconsumeraffairs.gov/](https://www.njconsumeraffairs.gov/)

- Phone: (973) 504-6200

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works to protect consumers and promote a fair and stable insurance marketplace. It provides information on insurance regulations and consumer rights.

- Website: [https://www.naic.org/](https://www.naic.org/)

- Better Business Bureau (BBB): The BBB provides information on businesses, including insurance companies, and helps consumers resolve disputes.

- Website: [https://www.bbb.org/](https://www.bbb.org/)

Independent Organizations

Independent organizations provide valuable information and resources on insurance, helping you make informed decisions about your coverage.

- Insurance Information Institute (III): The III is a non-profit organization that provides information and research on insurance topics, including car insurance.

- Website: [https://www.iii.org/](https://www.iii.org/)

- Consumer Reports: Consumer Reports provides independent reviews and ratings of products and services, including car insurance companies.

- Website: [https://www.consumerreports.org/](https://www.consumerreports.org/)

Case Studies of Affordable Car Insurance in NJ

Finding affordable car insurance in New Jersey can be a challenge, but it’s achievable with the right strategies. Many individuals have successfully navigated the insurance market and secured policies that fit their budgets. These case studies highlight successful strategies and real-world examples of how to find affordable car insurance in NJ.

Case Studies of Individuals Who Found Affordable Car Insurance

Several individuals have successfully found affordable car insurance in New Jersey by implementing effective strategies. For example, a young driver named Sarah, who was initially quoted high premiums due to her age and lack of driving experience, found a more affordable policy by taking a defensive driving course and maintaining a clean driving record.

Another example is John, who was able to reduce his premiums by bundling his car insurance with his homeowners insurance. He also compared quotes from multiple insurance companies and ultimately chose the one that offered the most competitive price for his needs.

These examples illustrate that finding affordable car insurance in NJ requires research, comparison, and strategic decision-making.

Strategies for Saving Money on Car Insurance

Several effective strategies can help individuals save money on car insurance in NJ.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant discounts. Insurance companies typically offer discounts for bundling multiple policies with them.

Maintaining a Clean Driving Record

A clean driving record is essential for securing lower car insurance premiums. Avoiding traffic violations, accidents, and other driving offenses can significantly reduce your insurance costs.

Taking Defensive Driving Courses

Completing a defensive driving course can demonstrate your commitment to safe driving practices and potentially qualify you for discounts on your car insurance.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurance companies is crucial to finding the most affordable option. Online comparison tools and websites can streamline this process and help you identify the best deals.

Negotiating with Your Insurance Company

Don’t be afraid to negotiate with your insurance company. If you have a clean driving record and have been with the company for a while, you may be able to negotiate a lower premium.

Exploring Discounts

Many insurance companies offer various discounts, such as good student discounts, safe driver discounts, and multi-car discounts. Be sure to inquire about all available discounts and ensure you qualify for them.

Navigating the Insurance Market in NJ

Navigating the insurance market in NJ requires understanding the available options, comparing quotes, and negotiating effectively.

Researching Insurance Companies

Researching different insurance companies, understanding their coverage options, and reading customer reviews can help you make informed decisions.

Understanding Coverage Options

Familiarize yourself with the different types of coverage available, such as liability, collision, comprehensive, and uninsured motorist coverage. This knowledge will help you determine the most appropriate coverage for your needs.

Utilizing Online Comparison Tools

Online comparison tools and websites can simplify the process of comparing quotes from multiple insurance companies. These tools allow you to enter your information once and receive quotes from various providers, making it easier to identify the best deals.

Consulting with an Insurance Broker

Consulting with an independent insurance broker can provide valuable insights and guidance. Brokers have access to a wide range of insurance companies and can help you find the most suitable and affordable policy for your situation.

Reading Policy Documents Carefully

Before signing any insurance policy, carefully read the policy documents to understand the coverage details, exclusions, and any limitations.

Conclusion

Navigating the world of car insurance in New Jersey can be complex, but with the right information and tools, securing affordable coverage is achievable. This guide has provided a comprehensive overview of key factors influencing car insurance costs, strategies for finding savings, and understanding the nuances of New Jersey’s insurance landscape.

Key Takeaways

- Factors influencing car insurance costs: Several factors contribute to car insurance premiums in New Jersey, including driving history, vehicle type, age, and location. Understanding these factors empowers you to make informed choices that can impact your insurance costs.

- Comparing quotes: Actively comparing quotes from multiple insurance providers is crucial to finding the best value. Online comparison tools can streamline this process and help you identify competitive options.

- Discounts and savings: Taking advantage of available discounts, such as safe driving records, bundling insurance policies, and installing safety features, can significantly reduce your premiums.

- Navigating the claims process: Understanding the steps involved in filing a claim and knowing your rights as a policyholder ensures a smoother experience in case of an accident.

Actionable Steps

Armed with this knowledge, take proactive steps to secure affordable car insurance:

- Compare quotes: Utilize online comparison tools or contact multiple insurance providers directly to get personalized quotes.

- Explore discounts: Identify eligible discounts and ensure your insurance policy reflects them.

- Maintain a safe driving record: Avoid traffic violations and accidents to maintain a good driving history, which can significantly impact your premiums.

- Review your coverage regularly: As your needs change, review your coverage to ensure it remains adequate and cost-effective.

Outcome Summary

Armed with this information, you can confidently navigate the complexities of car insurance in New Jersey. By understanding the factors influencing your rates, exploring available discounts, and comparing quotes, you can secure the most affordable coverage that meets your specific needs. Remember, finding affordable car insurance doesn’t have to be a daunting task. With a proactive approach and a little research, you can unlock the best insurance rates and drive with peace of mind.