The hunt for the perfect auto insurance policy can feel like a daunting quest, riddled with complex jargon and seemingly endless options. But fear not, intrepid drivers! This guide will equip you with the knowledge and tools to navigate the world of auto insurance quote comparisons with confidence.

From understanding the key factors that influence premiums to mastering the art of comparing quotes from different providers, we’ll unravel the intricacies of this crucial process. We’ll explore the various methods for obtaining quotes, including online comparison websites, direct contact with insurance companies, and the role of insurance brokers. By the end of this journey, you’ll be empowered to make informed decisions that secure the best possible coverage at a price that suits your budget.

Understanding Auto Insurance Quote Comparisons

Auto insurance is a necessity for most vehicle owners, but it can be expensive. Comparing quotes from different insurers can help you find the best coverage at the most affordable price.

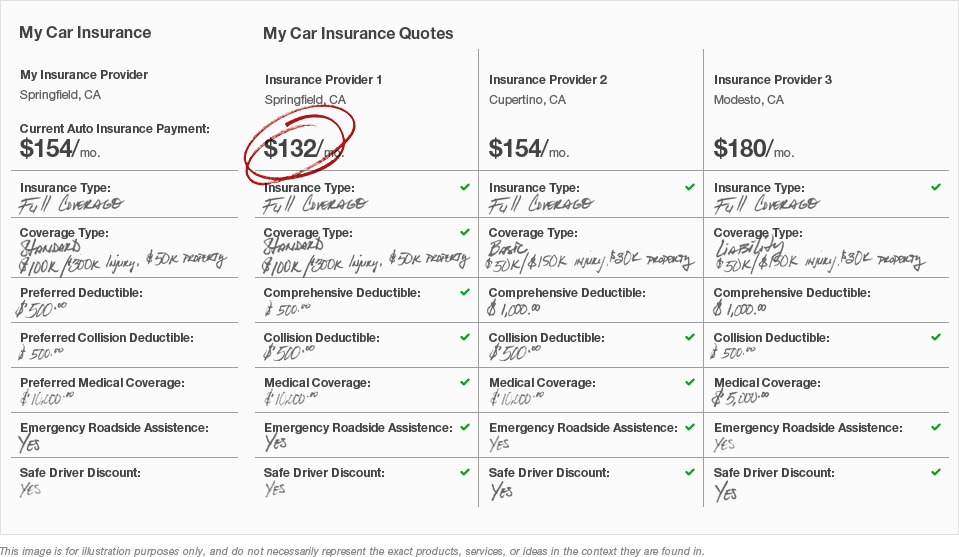

By comparing quotes, you can ensure you are getting the most competitive rates for the coverage you need. This process involves obtaining quotes from multiple insurance companies and comparing them side-by-side to identify the best value.

Factors Influencing Auto Insurance Premiums

Several factors influence the cost of auto insurance premiums. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

- Driving History: Your driving record, including accidents, tickets, and DUI convictions, significantly impacts your premium. A clean driving record usually translates to lower premiums.

- Age and Gender: Younger and inexperienced drivers typically pay higher premiums due to a higher risk of accidents. Gender also plays a role, with males generally paying more than females.

- Vehicle Type and Value: The make, model, and year of your vehicle affect premiums. Expensive, high-performance cars generally attract higher premiums due to their repair costs and potential for theft.

- Location: Your location, including the state and city, impacts your premium. Areas with higher accident rates or theft rates tend to have higher premiums.

- Coverage Levels: The amount of coverage you choose, such as liability limits, comprehensive, and collision, influences your premium. Higher coverage levels generally mean higher premiums.

- Credit Score: Your credit score can impact your auto insurance premiums in some states. Insurers may view a good credit score as an indicator of responsible behavior and may offer lower premiums to those with good credit.

Tips for Obtaining Accurate and Comprehensive Quotes

Obtaining accurate and comprehensive quotes is crucial for making informed decisions about your auto insurance. Here are some tips for getting the most accurate and complete quotes:

- Provide Accurate Information: Ensure you provide accurate information about yourself, your vehicle, and your driving history when requesting quotes. Inaccurate information can lead to inaccurate quotes and potential problems later.

- Compare Apples to Apples: When comparing quotes, ensure you are comparing the same coverage levels from different insurers. Different insurers may offer different coverage options, so it’s important to ensure you are comparing like-for-like.

- Consider Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your vehicle, or bundling multiple insurance policies. Ask about available discounts and ensure they are included in your quotes.

- Read the Fine Print: Before committing to an insurance policy, carefully review the policy documents to understand the coverage details, exclusions, and limitations. Don’t hesitate to ask questions if anything is unclear.

Key Considerations for Auto Insurance Quotes

Navigating the world of auto insurance quotes can be overwhelming, with numerous factors influencing the final price. To make informed decisions, understanding key considerations is paramount. This section delves into essential features that can significantly impact your premiums, empowering you to compare quotes effectively and choose the best coverage for your needs.

Coverage Limits and Deductibles

Coverage limits and deductibles are two fundamental aspects of auto insurance policies that significantly influence premiums. Understanding their interplay is crucial for making informed decisions.

Coverage limits define the maximum amount your insurer will pay for covered losses, such as bodily injury or property damage. Higher coverage limits generally translate to higher premiums but offer greater financial protection in case of major accidents.

Deductibles represent the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles often lead to lower premiums, as you assume a greater portion of the financial burden in case of a claim.

Choosing appropriate coverage limits and deductibles involves balancing your risk tolerance and budget.

For instance, if you drive an older car with lower value, a higher deductible might be more appealing, as you might be willing to pay a larger amount out-of-pocket in exchange for lower premiums. Conversely, if you drive a new car with higher value or have a higher risk tolerance, opting for lower deductibles and higher coverage limits could be more advantageous.

Types of Auto Insurance Policies

Different types of auto insurance policies offer varying levels of coverage and protection. Understanding the benefits and drawbacks of each type is essential for choosing the right policy for your needs.

- Liability Coverage: This is the most basic type of auto insurance, legally required in most states. It covers damages to others’ property or injuries caused by you in an accident, including medical expenses and lost wages. Liability coverage is typically divided into two limits: bodily injury liability and property damage liability.

- Collision Coverage: This covers damages to your vehicle in an accident, regardless of fault. Collision coverage is optional but can be crucial if you finance or lease your car, as lenders often require it.

- Comprehensive Coverage: This protects your vehicle against damages from non-collision events, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is also optional but can be valuable for newer or more expensive vehicles.

- Uninsured/Underinsured Motorist Coverage: This protects you in case of an accident caused by a driver without insurance or insufficient coverage. Uninsured/underinsured motorist coverage is essential, as it can cover your medical expenses and property damage if the other driver cannot afford to pay for the damages.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, pays for your medical expenses and lost wages after an accident, regardless of fault. PIP coverage is mandatory in some states and optional in others.

Choosing the right type of auto insurance policy depends on your individual circumstances, including your driving history, the value of your vehicle, and your risk tolerance. For example, if you drive an older car with a lower value, you might choose to forgo collision and comprehensive coverage, opting for liability coverage and uninsured/underinsured motorist coverage instead. Conversely, if you drive a new car with a higher value, you might opt for comprehensive coverage to protect your investment.

Other Important Considerations

Beyond coverage limits, deductibles, and policy types, other factors can influence your auto insurance premiums.

- Driving History: Your driving record, including accidents, traffic violations, and driving convictions, significantly impacts your premiums. A clean driving record generally leads to lower premiums, while a history of accidents or violations can increase them.

- Vehicle Type: The make, model, and year of your vehicle play a role in determining your premiums. Sports cars, luxury vehicles, and high-performance cars are often associated with higher risks and therefore higher premiums. Conversely, smaller, fuel-efficient cars tend to have lower premiums.

- Location: Where you live can also influence your premiums. Areas with higher crime rates, traffic congestion, and accident frequency generally have higher insurance rates. Conversely, areas with lower risk factors tend to have lower premiums.

- Credit Score: In some states, insurers use your credit score as a factor in determining your premiums. This practice is controversial, but it is legal in many states. A higher credit score generally leads to lower premiums, while a lower credit score can increase them.

- Discounts: Many insurers offer discounts for safe driving, good student status, multiple vehicle coverage, and other factors. Taking advantage of available discounts can significantly reduce your premiums.

Methods for Comparing Auto Insurance Quotes

Obtaining the best auto insurance rate requires comparing quotes from multiple providers. Several methods are available, each with advantages and disadvantages.

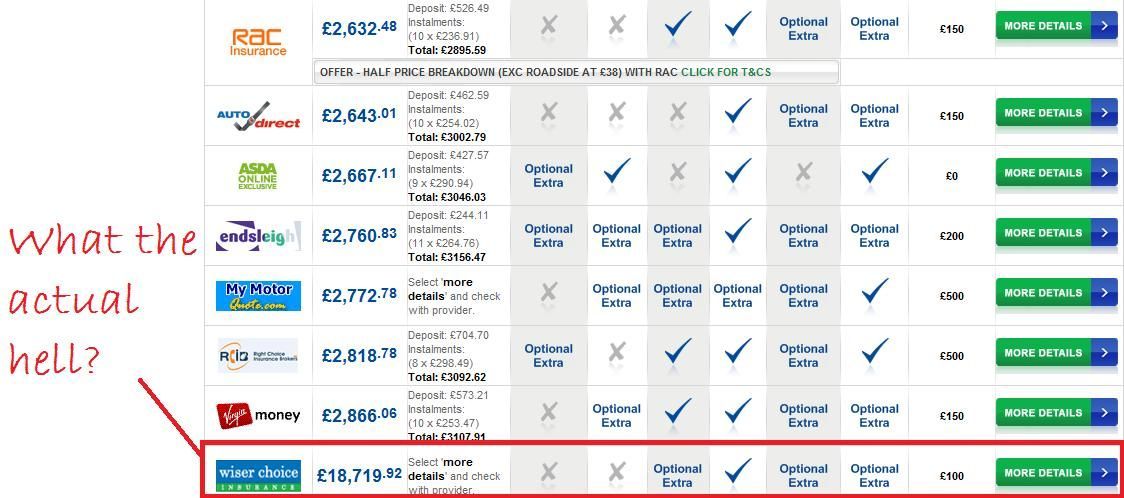

Online Quote Comparison Websites

These websites allow users to compare quotes from various insurance companies simultaneously. They typically gather basic information about your vehicle, driving history, and location, then display quotes from their partner insurance companies.

Table Comparing Online Quote Comparison Websites

| Website | Features | Pros | Cons |

|—|—|—|—|

| [Website Name] | [List of Features] | [List of Pros] | [List of Cons] |

| [Website Name] | [List of Features] | [List of Pros] | [List of Cons] |

| [Website Name] | [List of Features] | [List of Pros] | [List of Cons] |

It is important to note that these websites may not always include all insurance companies in their comparisons. They also might not always provide the most accurate quotes, as they rely on the information you provide and may not have access to your complete driving history.

Obtaining Quotes Directly from Insurance Companies

This method involves contacting insurance companies individually and providing them with your information. This allows for a more personalized experience, as you can discuss your specific needs and ask questions about their policies.

Step-by-Step Guide

1. Gather your information. This includes your driver’s license, vehicle registration, and any relevant information about your driving history, such as accidents or violations.

2. Contact the insurance companies directly. You can do this by phone, email, or through their websites.

3. Provide them with your information. Be sure to be accurate and complete.

4. Compare the quotes. Once you receive quotes from multiple companies, compare the coverage, premiums, and other features to find the best option for your needs.

Insurance Brokers

Insurance brokers act as intermediaries between you and insurance companies. They can help you find the best coverage at the best price, as they have access to quotes from multiple companies.

Advantages and Disadvantages

Advantages:

* Access to a wider range of insurance companies: Brokers have relationships with multiple insurance companies, which can give you access to a wider range of options.

* Personalized advice: Brokers can provide you with personalized advice and help you understand your insurance options.

* Negotiation power: Brokers may be able to negotiate better rates on your behalf.

Disadvantages:

* Fees: Brokers may charge a fee for their services.

* Limited options: Some brokers may only represent a limited number of insurance companies.

* Potential conflicts of interest: Brokers may be incentivized to recommend certain insurance companies over others.

Factors Affecting Auto Insurance Premiums

Your auto insurance premium is determined by a variety of factors, each contributing to the overall cost. Understanding these factors can help you make informed decisions to potentially lower your premium.

Driving History

Your driving history is a significant factor in determining your insurance premium. A clean driving record with no accidents or violations typically results in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions can significantly increase your premium.

Insurers consider the severity and frequency of your past driving incidents, as they indicate your risk profile.

Vehicle Type

The type of vehicle you drive is another crucial factor. Factors like the vehicle’s make, model, year, and safety features can influence your premium.

- High-performance vehicles, luxury cars, and expensive sports cars are often associated with higher premiums due to their higher repair costs and potential for higher risks.

- Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, can lead to lower premiums as they reduce the risk of accidents and injuries.

Location

Your location plays a significant role in determining your insurance premium. Factors like the population density, crime rate, and frequency of accidents in your area can influence your premium.

- Urban areas with higher traffic congestion and crime rates often have higher insurance premiums due to the increased risk of accidents and theft.

- Rural areas with lower population density and less traffic generally have lower insurance premiums.

Tips for Saving on Auto Insurance

Auto insurance premiums can be a significant expense, but there are several strategies you can employ to lower your costs. By understanding the various discounts available and negotiating effectively with insurance companies, you can significantly reduce your annual premiums.

Discounts for Safe Driving

Safe driving habits are rewarded by insurance companies through discounts. These discounts are designed to incentivize responsible driving and acknowledge the reduced risk associated with drivers who have a proven track record of safe driving.

- Good Driver Discounts: These are awarded to drivers who maintain a clean driving record, free of accidents, traffic violations, or other incidents that indicate risky driving behavior. Insurance companies view drivers with a clean record as less likely to file claims, resulting in lower premiums.

- Defensive Driving Course Discounts: Completing a certified defensive driving course demonstrates your commitment to safe driving practices and can lead to significant premium reductions. These courses teach drivers about defensive driving techniques, traffic laws, and risk management, equipping them with the knowledge and skills to avoid accidents.

- Accident-Free Discounts: Insurance companies often reward drivers who have been accident-free for a specific period, typically several years. This discount reflects the lower risk associated with drivers who have consistently demonstrated safe driving habits.

Discounts for Good Student Records

Insurance companies recognize that good students are often more responsible and cautious, leading to lower risk profiles.

- Good Student Discounts: These discounts are typically offered to students who maintain a certain grade point average (GPA) or are enrolled in a college or university. By rewarding good academic performance, insurance companies incentivize responsible behavior and encourage students to prioritize their education.

Discounts for Bundling Policies

Insurance companies often offer discounts for bundling multiple insurance policies, such as auto, home, and renters insurance, into a single package. This strategy is beneficial for both the insurance company and the policyholder.

- Bundling Discounts: By insuring multiple policies with the same company, policyholders can benefit from reduced premiums and streamlined management of their insurance needs. Insurance companies, in turn, gain a more loyal customer base and increased revenue from multiple policy sales.

Negotiating with Insurance Companies

Negotiating with insurance companies can be an effective way to secure lower premiums.

- Shop Around for Quotes: Obtaining quotes from multiple insurance companies allows you to compare prices and coverage options. This competitive process puts pressure on insurance companies to offer competitive rates to retain your business.

- Highlight Your Positive Driving Record: Emphasize your clean driving history, accident-free years, and any defensive driving courses you have completed. These factors demonstrate your commitment to safe driving and can influence the insurer’s perception of your risk profile.

- Explore Payment Options: Inquire about payment options that may lead to discounts, such as paying your premium annually instead of monthly. This option often results in a lower overall premium due to the elimination of monthly service charges.

- Consider Increasing Your Deductible: Raising your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lower your premium. This strategy involves accepting more financial responsibility in the event of an accident, but it can significantly reduce your insurance costs.

Choosing the Right Auto Insurance Policy

Selecting the right auto insurance policy is crucial to ensuring you have adequate protection in case of an accident or other unforeseen events. This involves understanding your individual needs and coverage requirements, and making informed decisions about coverage limits, deductibles, and the insurance company you choose.

Determining Coverage Limits and Deductibles

Choosing the right coverage limits and deductibles is essential for balancing financial protection and affordability.

- Liability Coverage: This covers damages to others’ property and injuries in an accident you cause. The minimum required liability limits vary by state, but higher limits offer greater protection against significant financial losses.

- Collision Coverage: This covers repairs or replacement of your vehicle in case of an accident, regardless of fault. Higher deductibles mean lower premiums, but you pay more out-of-pocket for repairs.

- Comprehensive Coverage: This covers damage to your vehicle from non-accident events like theft, vandalism, or natural disasters. Deductibles work similarly to collision coverage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are hit by a driver without insurance or with insufficient coverage.

To determine the optimal coverage limits and deductibles, consider your financial situation, the value of your vehicle, and your risk tolerance. For example, if you have a newer car with a high value, you might opt for higher coverage limits and lower deductibles to ensure adequate protection in case of a major accident. Conversely, if you have an older car with a lower value, you might choose lower coverage limits and higher deductibles to save on premiums.

Understanding Policy Terms and Conditions

Navigating the complex world of auto insurance requires understanding the intricate details of your policy. Beyond the premium amount, it’s crucial to comprehend the terms and conditions that govern your coverage. This knowledge empowers you to make informed decisions about your insurance needs and ensure you’re adequately protected.

Key Terms and Conditions

A comprehensive understanding of common policy terms is essential for maximizing your coverage and avoiding unexpected surprises.

- Deductible: The amount you pay out-of-pocket before your insurance kicks in to cover the remaining costs of an accident or claim. A higher deductible typically results in a lower premium.

- Coverage Limits: The maximum amount your insurance company will pay for a covered loss. These limits vary by coverage type, and understanding them is crucial for determining if your policy provides sufficient protection.

- Exclusions: Specific situations or events that are not covered by your policy. Examples include damage caused by wear and tear, intentional acts, or driving under the influence.

- Premium: The amount you pay for your insurance policy. Factors such as your driving history, vehicle type, and location influence the premium.

- Renewal: The process of extending your insurance policy for another term. Your insurer may adjust your premium based on factors like changes in your driving record or vehicle value.

Types of Coverage

Standard auto insurance policies typically include various coverages designed to protect you and your vehicle in different situations.

- Liability Coverage: Covers damages to other people’s property or injuries caused by an accident you are responsible for. It includes bodily injury liability and property damage liability.

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault. It typically includes a deductible, and the payout is limited to the actual cash value of your vehicle.

- Comprehensive Coverage: Covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or natural disasters. Like collision coverage, it usually includes a deductible.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you are involved in an accident with a driver who has no insurance or insufficient coverage.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

Importance of Reading Policy Documents

Thoroughly reading and understanding your policy documents is crucial to ensure you’re aware of your coverage limits, exclusions, and other important terms. This can help you avoid costly mistakes and ensure you have adequate protection.

- Review the policy carefully: Pay attention to the specific language used and seek clarification if anything is unclear.

- Ask questions: Don’t hesitate to contact your insurance agent or company representative if you have any questions or concerns about your policy.

- Keep a copy of your policy: Ensure you have easy access to your policy documents for future reference.

The Role of Technology in Auto Insurance Comparisons

The rise of technology has revolutionized the way we compare auto insurance quotes, making the process more efficient, accessible, and personalized than ever before. Online platforms and mobile apps have streamlined the quote comparison process, allowing consumers to obtain quotes from multiple insurers within minutes, eliminating the need for lengthy phone calls or in-person visits.

The Use of Online Platforms and Mobile Apps

Online platforms and mobile apps have become the go-to tools for obtaining auto insurance quotes. These platforms provide a user-friendly interface that simplifies the quote comparison process. Consumers can input their personal and vehicle information into a single form and receive multiple quotes from different insurers instantly.

- Many platforms allow users to customize their search parameters, such as coverage levels, deductibles, and discounts, to find the most suitable policy based on their specific needs.

- These platforms often provide comprehensive information about each insurer, including their financial strength, customer satisfaction ratings, and coverage options.

- Mobile apps offer the added convenience of comparing quotes on the go, making it easier for consumers to shop for insurance at any time and from any location.

The Benefits of Using Data-Driven Tools for Personalized Recommendations

Data-driven tools leverage sophisticated algorithms to analyze vast amounts of data, including individual driving history, demographics, and vehicle information, to generate personalized recommendations. These tools can identify potential discounts and coverage options that might not be readily apparent to consumers.

- By analyzing individual risk profiles, data-driven tools can provide more accurate and relevant quotes, leading to potentially lower premiums.

- These tools can also offer insights into the coverage options that best suit individual needs, helping consumers make informed decisions about their insurance coverage.

Legal and Regulatory Aspects of Auto Insurance

The legal framework surrounding auto insurance is intricate and varies significantly across states, encompassing a complex web of regulations and legal requirements. This framework ensures that drivers have adequate financial protection in case of accidents, while also promoting fair and transparent insurance practices.

State Regulations and Insurance Commissions

Each state has its own unique set of laws and regulations governing auto insurance. These regulations are typically enforced by state insurance commissions, which are responsible for overseeing the insurance industry within their respective states. State insurance commissions play a crucial role in ensuring that insurance companies operate fairly and responsibly.

- State insurance commissions are empowered to license and regulate insurance companies operating within their jurisdictions.

- They establish minimum coverage requirements, ensuring that drivers have adequate financial protection for potential liabilities arising from accidents.

- They set standards for insurance rates and underwriting practices, aiming to prevent unfair pricing and discrimination.

- They investigate consumer complaints and take action against insurers engaging in fraudulent or unethical practices.

- They conduct market analysis and monitor insurance trends to identify potential risks and ensure the stability of the insurance market.

Importance of Complying with Insurance Laws and Regulations

Complying with insurance laws and regulations is paramount for both insurance companies and policyholders.

- Insurance companies are required to comply with all applicable state laws and regulations, ensuring they offer coverage that meets minimum requirements and operate ethically.

- Policyholders are responsible for understanding and complying with the terms and conditions of their insurance policies, including paying premiums on time and providing accurate information.

- Failure to comply with insurance laws and regulations can result in severe consequences, including fines, penalties, or even revocation of insurance licenses.

Best Practices for Auto Insurance Comparisons

Navigating the complex world of auto insurance quotes can be overwhelming. To ensure you secure the most favorable coverage at the best possible price, it’s crucial to adopt a strategic approach and follow best practices. This section delves into key steps to optimize your auto insurance comparison process, helping you make informed decisions.

Checklist for Effective Auto Insurance Comparisons

A comprehensive checklist can serve as a roadmap for your auto insurance comparison journey. It ensures you cover all essential aspects and avoid overlooking crucial details.

- Gather Personal Information: Before initiating comparisons, gather all necessary personal details, including your driver’s license number, Social Security number, and vehicle information (make, model, year, VIN). This information is typically required by insurance providers to generate accurate quotes.

- Define Your Coverage Needs: Determine your specific coverage requirements based on your individual circumstances and risk tolerance. Factors such as your vehicle’s value, driving history, and financial situation play a role in shaping your insurance needs. Consider essential coverages like liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Identify Reputable Insurance Providers: Research and identify reputable insurance providers in your area. Seek recommendations from friends, family, and online reviews. Look for companies with a strong financial rating, positive customer feedback, and a track record of reliable claims handling.

- Compare Quotes from Multiple Providers: Request quotes from at least three to five different insurance providers. This allows you to compare prices, coverage options, and customer service levels across various companies. Utilize online comparison tools or contact providers directly to obtain quotes.

- Review Policy Details Carefully: Once you receive quotes, carefully review the policy details of each provider. Pay attention to coverage limits, deductibles, exclusions, and any additional fees or charges. Ensure you understand the terms and conditions of each policy before making a decision.

- Consider Discounts and Bundling Options: Explore available discounts and bundling options offered by insurance providers. Discounts may be available for good driving records, safety features in your vehicle, or bundling multiple insurance policies with the same provider. These discounts can significantly reduce your premium costs.

- Seek Professional Advice: If you find the comparison process overwhelming or have complex insurance needs, consider consulting with an independent insurance agent or broker. They can provide personalized advice, help you navigate policy options, and ensure you have the right coverage for your specific circumstances.

Avoiding Common Pitfalls and Mistakes

When comparing auto insurance quotes, it’s essential to avoid common pitfalls that can lead to suboptimal decisions.

- Focusing Solely on Price: While price is a crucial factor, it shouldn’t be the only consideration. Remember that the cheapest option may not always offer the best coverage or customer service. Carefully assess the overall value proposition of each provider, including their reputation, financial stability, and claims handling process.

- Ignoring Coverage Limits: Don’t underestimate the importance of adequate coverage limits. Choose limits that are sufficient to cover potential liabilities and repair costs in case of an accident. Insufficient coverage can leave you financially vulnerable in the event of a claim.

- Failing to Consider Deductibles: Deductibles represent the amount you pay out of pocket before your insurance coverage kicks in. While higher deductibles generally result in lower premiums, ensure you can afford the deductible in case of a claim. Choose a deductible that aligns with your financial situation and risk tolerance.

- Skipping Policy Reviews: Once you’ve chosen a policy, it’s essential to review it periodically to ensure it still meets your needs. Your insurance needs may change over time, such as when you acquire a new vehicle or experience changes in your driving habits. Regularly reviewing your policy helps you stay informed and make adjustments as needed.

Future Trends in Auto Insurance

The auto insurance industry is undergoing a significant transformation driven by emerging technologies, shifting consumer expectations, and evolving regulatory landscapes. These trends are reshaping how insurers assess risk, price policies, and interact with customers.

The Impact of Emerging Technologies

The rise of connected cars, autonomous vehicles, and advanced data analytics is fundamentally changing the way auto insurance is priced and underwritten. Connected cars generate a wealth of data on driving behavior, vehicle performance, and environmental conditions. This data allows insurers to develop more accurate risk assessments, personalize pricing, and offer usage-based insurance (UBI) programs.

The Role of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are playing an increasingly prominent role in auto insurance. These technologies enable insurers to automate tasks, improve decision-making, and personalize customer experiences. For example, AI-powered chatbots can handle routine customer inquiries, while ML algorithms can analyze vast amounts of data to identify risk factors and predict claims.

The Future of Auto Insurance Quote Comparisons

The future of auto insurance quote comparisons will be characterized by greater transparency, personalization, and convenience. Insurers are leveraging technology to provide customers with real-time quotes tailored to their individual needs. Online platforms and mobile apps will continue to simplify the comparison process, allowing consumers to easily compare quotes from multiple insurers and select the best policy for their needs.

Closing Summary

In the ever-evolving landscape of auto insurance, staying informed is key. Armed with the knowledge gleaned from this guide, you’ll be able to confidently compare quotes, negotiate for the best rates, and ultimately secure the right policy for your needs. Remember, a little effort upfront can save you significant money and peace of mind in the long run. So, buckle up and embark on your journey towards optimal auto insurance coverage!